Indonesian Stocks Ends Higher, Trade Surplus Shrinks Less than Expected.

Indonesian stocks reversed in green zone after profit taking activities weighed index down in early trade with investors reacted to trade data release.

Jakarta composite added 7.224 points (+0.109%) to 6,633.338 while LQ45 slipped 0.04% to 972.206. There were 21.809 billion shares traded worth of Rp17.635 trillion, including transaction of Rp3.755 trillion in negotiation market. Foreign investors purchased a net Rp664.79 billion in regular market. 244 shares rose while 258 declined and 163 unchanged.

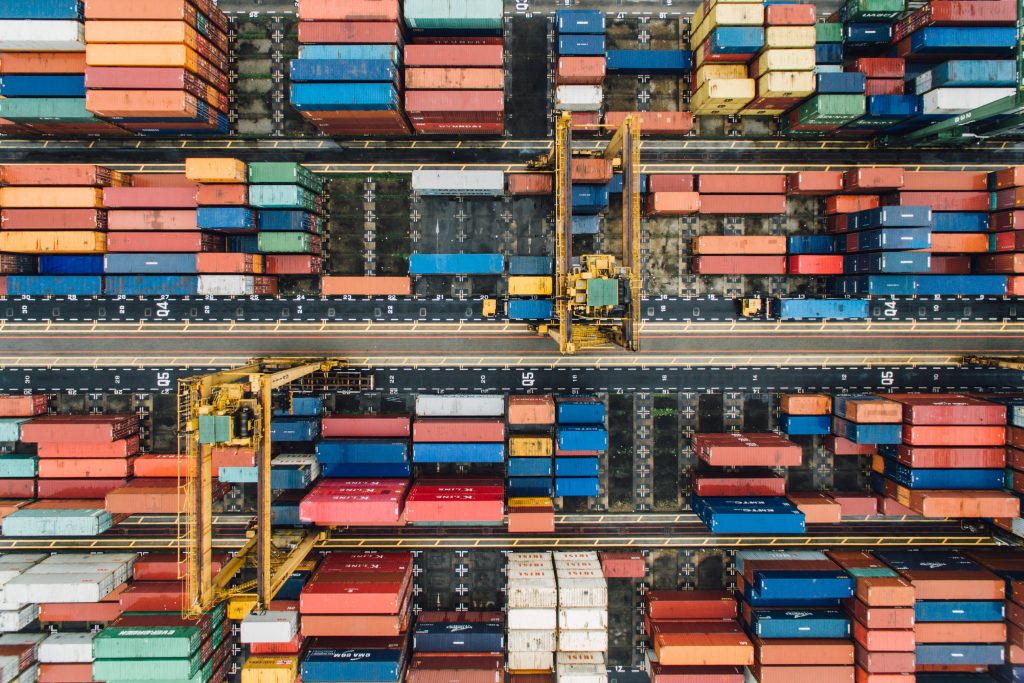

Indonesia’s trade surplus narrowed in September, albeit less than expected, to $4.37 billion, from an all-time high trade surplus of $4.74 billion in August and against an expected surplus of $3.84 billion. September exports were worth $20.60 billion, up 47.64% on a yearly basis, compared with the poll’s 51.57% growth forecast. Imports rose 40.31% to $16.23 billion, versus the poll’s 50% forecast.

Foreigners remained the preeminent buying force in equity market with BBRI and BMRI were the most collected.

The Financial Services Authority is preparing a blueprint for the digital transformation of banking that will be launched on October 26 that will present a more detailed description of Indonesia’s banking development road map.

Rupiah continue to strengthen. According to JISDOR released Friday afternoon, rose 71 points (+0.46%) at 14,084 while spot rate rose 45 points (+0.32%) at 14,070.

Stocks were higher on Friday along with U.S. equity futures as solid company earnings so far have helped calm inflation fears.

Hong Kong stocks returned to trade on Friday after stock markets in the city were closed for two days.

China is loosening restrictions on home loans at some of its largest banks, adding to signs of growing concern by authorities about contagion from the debt crisis at China Evergrande Group.

U.S. data showed that the producer price index rose 0.5% month-on-month in September, while a lower-than-expected 293,000 initial jobless claims were filed throughout the week.

In Europe, French consumer price inflation came in at negative 0.2% month-on-month in September. On an annual basis, it was 2.7% higher.

The U.S. 10-year Treasury yield edged up and the dollar was steady. Bitcoin extended a climb on expectations the Securities and Exchange Commission will allow the first U.S. Bitcoin futures exchange-traded fund.

Oil prices climbed on Friday, heading for gains of more than 2% for the week. The International Energy Agency on Thursday said the energy crunch is expected to boost oil demand by 500,000 bpd. That would result in a supply gap of around 700,000 bpd through the end of this year. Brent rose 84 cents (+1.00%) at $84.84 per barrel and U.S WTI up 74 cents (+0.91%) at $82.05 a barrel.

STOXX 50.. 4,164.40 (+0.37%)

CAC 40.. 6,710.47 (+0.38%)

DAX.. 15,481.60 (+0.12%)

FTSE.. 7,225.50 (+0.25%)

NIKKEI.. 29,068.63 (+1.81%)

HSI.. 25,288.76 (+1.31%)

SHCOMP.. 3,572.37 (+0.40%)

TAIEX.. 16,781.19 (+2.40%)

KOSPI.. 3,015.06 (+0.88%)

S&P/ASX 200.. 7,361.98 (+0.69%)

STI.. 3,183.48 (+0.59%)

DOW FUT.. 34,917.00 (+0.38%)

S&P FUT.. 4,445.75 (+0.36%)

NASDAQ FUT.. 15,078.50 (+0.27%)

CI @6633.34 (+7.224pts) (+0.109%)

(H: 6680.01 ; L: 6573.34)

(Value: 17.574 T (NG 3.755 T)

Volume: 213.749 Lot (NG 38.791 M Lot)

(Adv.239 ; Decl.257 ; Unchg.162 shares)

Foreign Nett Buy 1.503,16 B…!!!

Incl.Crossing**

– FILM @488 ~ 811.04 B (F vs D)

– BBCA @7636 ~ 542.97 B (F vs F)

– BBSI @908 ~ 439.68 B (D vs D)

– SMMA @10145 ~ 354.01 B (D vs F)

– BBRI @4234 ~ 321.32 B (F vs F)

– BMRI @7129 ~ 127.77 B (F vs D)

– BULL @270 ~ 121.64 B (D vs D)

– ASII @6237 ~ 112.95 B (F vs F)

Foreign Value 30.4%

IDXHIDIV20…482.44(-0.20%)

IDX30…517.26(-0.05%)

LQ45…972.21(-0.05%)

*BUY (Regular)

F Buy 3786.6 B

D Buy 10081.4 B

*SELL (Regular)

F Sell 3121.8 B

D Sell 10746.2 B

USD/IDR:

JISDOR: 14,155 ; 14,084

SPOT: 14,115 ; 14,070

JCI for Next Monday:

Support : 6625, 6600

Resist : 6650, 6675

8 MARKETs DRIVEN BY SECTOR

IDXBASIC (+0.66%) (2.56 T)

IDXENERGY (-0.04%) (1.65 T)

IDXFINANCE (+0.53%) (6.73 T)

IDXHEALTH (-0.46%) (470.70 B)

IDXINDUST (-0.18%) (953.44 B)

IDXINFRA (+0.60%) (1.16 T)

IDXPROPERT (+0.86%) (349.47 B)

IDXTECHNO (-0.44%) (386.24 B)

7 INDEX MOVER FOR LQ45

BBCA @7650 (-1.29%)

BBRI @4320 (+1.65%)

TLKM @3810 (-0.52%)

BMRI @7150 (-0.35%)

ASII @6250 (+0.40%)

UNVR @5225 (-1.88%)

TPIA @7150 (-1.04%)

7 TOP GAINERs

PTIS @352 (+24.82%)

GSMF @284 (+24.56%)

PANI @940 (+24.50%)

RONY @266 (+24.30%)

BPTR @200 (+22.70%)

ESSA @360 (+16.13%)

INPP @705 (+15.57%)

7 TOP LOSERs

MGLV @214 (-8.55%)

PUDP @404 (-6.91%)

MBSS @885 (-6.84%)

DART @246 (-6.82%)

GEMA @356 (-6.81%)

AYLS @181 (-6.70%)

CASA @392 (-6.67%)

8 NET BUY STOCKs BY FOREIGNERS

BBRI @4279 (734.46 B)

BMRI @7139 (90.60 B)

AGRO @1950 (53.70 B)

ADRO @1861 (41.35 B)

ITMG @25945 (34.60 B)

TBIG @2868 (33.13 B)

TOWR @1209 (30.68 B)

PTBA @2835 (25.49 B)

8 NET SELL STOCKs BY FOREIGNERS

UNVR @5233 (127.34 B)

BBNI @6784 (57.65 B)

SMGR @8850 (50.09 B)

INDF @6834 (46.93 B)

BBCA @7604 (40.77 B)

EXCL @3154 (32.88 B)

KLBF @1434 (20.30 B)

ERAA @607 (17.74 B)

8 MOST ACTIVE STOCKs BY VALUE

BBRI @4320 (+1.65%)

BBCA @7650 (-1.29%)

ANTM @2470 (+2.07%)

ARTO @13125 (+6.06%)

ASII @6250 (+0.40%)

MDKA @3250 (+5.18%)

BBNI @6750 (-1.82%)

UNVR @5225 (-1.88%)

8 MOST ACTIVE STOCKs BY VOLUME

FREN @95 (8.166.788 lot)

ZINC @124 (7.588.216 lot)

BUMI @87 (6.260.702 lot)

ESSA @360 (5.585.463 lot)

BIPI @50 (5.525.463 lot)

BEKS @79 (4.741.953 lot)

KBAG @57 (4.164.658 lot)

BRMS @101 (4.124.741 lot)